Ark Investment Management, founded by Catherine Wood, have updated their price target for Tesla (TSLA) after their big fourth quarter that saw record deliveries and earnings.

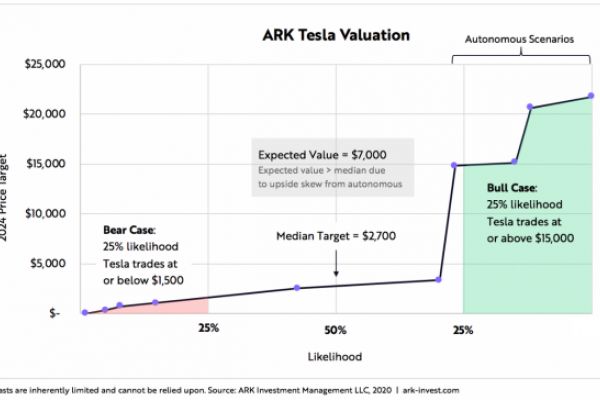

Back in February 2018, Wood originally projected a $4,000 share price target for Tesla. Then just last month, that was revised to $6,000 per share. Now their latest price target is even higher at $7,000 per share, which they give a 50% chance of happening.

Wood’s bear case, rated at a 25% probability is $1,500 per share, and their bull case (25% probability) is $15,000 (via Benzinga).

“Based on this probability matrix, our bear case implies that Tesla will sell 3.2 million vehicles in 2024, cutting its share of total EV sales roughly in half compared to today’s levels. Our bull case implies that Tesla will maintain it’s roughly 18% market share, and that a substantial percentage of its fleet will generate high-margin robotaxi platform flees,” according to ARK.“

There are a number of reasons for ARK’s most recent valuation, and they say the numbers back them up.

One of the reasons is Tesla’s ability to create a “multi-transactional business model” where it generates revenue from a number of sources, not just the sale of the vehicle. This includes the future “RoboTaxi” network.

Another reason is Autopilot and eventually Full Self-Driving (FSD). With Tesla’s existing fleet of over 600,000 vehicles already collecting and contributing data to the neural net that trains the autonomous driving software, is putting it so far ahead of the competition, no one else may be able to catch up.