Tesla has released their Q1 2020 statement before the earnings call later this afternoon, and posted some strong numbers within it, delivering the best Q1 earnings in the history of the electric automaker.

Earlier this month Tesla announced a new record of 88,400 vehicles delivered around the world. Those numbers were the strongest sales numbers in the first quarter of a year ever for Tesla, and that was despite the impact of coronavirus shutdowns for much of March.

The strong earnings continue what has been a 3 quarter streak of records earnings and profits to go along with the record delivery numbers. Tesla noted in their report these results were despite the challenges faced due to the coronavirus outbreak.

“Q1 2020 was the first time in our history that we achieved a positive GAAP net income in the seasonally weak first quarter. Despite global operational challenges, we were able to achieve our best first quarter for both production and deliveries.“

Here are the key figures:

Earnings

Tesla shareholders saw earnings of $0.94 per share versus estimates of a loss of $0.32 per share.

Revenue

Tesla reported total revenue of $5.985 billion versus estimates of $6.113 billion

Other news

Model Y

Tesla reports they are now able to reap the benefits of their scalable approach to manufacturing with the Model Y. In the first quarter, they were able to build more Model Y’s than the first two quarters of Model 3 production in 2017. They also noted the Model Y production exceeded the first quarter production of the Model 3 in Shanghai.

Giga Shanghai

Tesla expects the factory i China to achieve a production rate of approximately 4,000 units per week by the middle of the year. That equates to a strong 200,000 units per year.

Battery & Powertrain

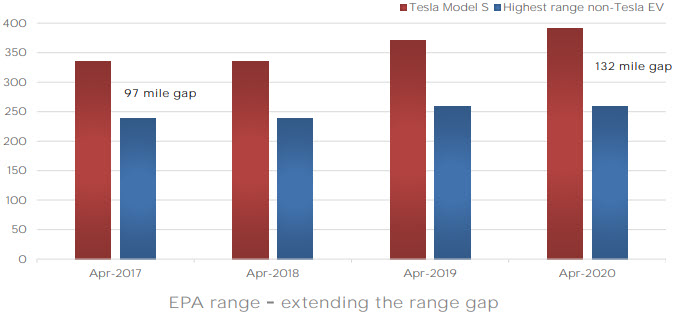

In their report, Tesla details that they were able to increase the range of the Model S and Model X, without a change in the size of the battery pack. They included a graph showing the highest range available on a Tesla vehicle over the past 3 years, and compared it to the highest range available on any non-Tesla EV. As of April 2020, Tesla holds a 132 mile (212km) lead over the competition.

Energy Business

According to Tesla, the demand for their utility level storage products (Megapack) continues to exceed their capacity. They also report that they have multiple project planned for the near future that will be larger than what is currently the largest Li-ion battery in the world in South Austraila.

Production of Tesla’s solar roof have increased, reaching a peak of 1,000 solar roofs in a single week.

As of publication, Tesla shares have risen to over $870USD in after-hours trading.

You can read more about the Q1 2020 earnings here. We’ll learn more after the earnings call, scheduled to take place at 3:30pm PST.

Developing, this story will be updated.