President-elect Donald Trump will reportedly repeal the $7,500 EV tax credit once his administration moves into the White House, a move that would shake up the electric vehicle (EV) market in the United States. While removing this benefit could slow EV adoption in the US, Tesla may actually stand to benefit from the change.

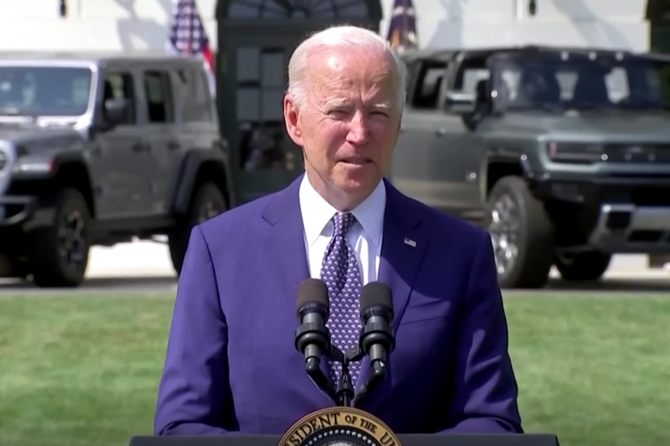

The tax credit, which provides a significant financial incentive for EV buyers, was introduced last year under President Joe Biden’s Inflation Reduction Act. However, it may soon be coming to an end. According to a report from Reuters, Trump’s energy-policy transition team, led by oil executive Harold Hamm, is prioritizing the repeal of Biden’s clean-energy policies, particularly the EV tax credit, as part of broader tax reform.

While this change might disadvantage Tesla’s competitors, the report also says, citing two different sources, that the company’s representatives have endorsed the proposal, viewing it as an opportunity to gain a competitive edge.

Tesla’s advantage in the face of a tax credit repeal lies in its scale, established market presence, and its finances. Unlike newer or legacy automakers, Tesla has achieved profitability thanks to its streamlined manufacturing and vertical integration strategies. By eliminating the tax credit, Tesla’s competitors would face higher entry barriers in the EV market, putting Tesla in a stronger position.

Elon Musk, who was a key figure in Trump’s election campaign, has himself said that the potential loss of subsidies under the incoming administration would “probably benefit Tesla” in the long run.

While the tax credit has undoubtedly fueled EV adoption, legacy automakers remain highly reliant on these incentives to keep their EVs competitive with gas-powered vehicles. Without this incentive, these automakers may struggle to maintain EV sales, especially as they continue to invest heavily in transitioning their manufacturing lines to EV production.

While removing the EV tax credit may curb EV adoption in the short term, Tesla’s established market lead and resilience may position it to emerge stronger, while at the same time creating a tougher environment for other automakers.

Here is a list of the Tesla models that currently qualify for the $7,500 tax credit.

- Model 3 Performance

- Model 3 Long Range All-Wheel Drive

- Model 3 Long Range Rear-Wheel Drive

- Model Y Performance

- Model Y Long Range All-Wheel Drive

- Model Y Long Range Rear-Wheel Drive

- Model X All-Wheel Drive